Our Blog

-

You are here:

- Home /

- Our Blog /

- Blog Business Applications /

- Your Guide to Year-End Close in Business Central for 2025

As 2025 comes to a close, it is time to make sure your books are accurate, compliant, and ready for audit. Closing the year in Microsoft Dynamics 365 Business Central (Business Central) locks your financials and carries them forward correctly. It sets you up for a clean start in 2026.

In this walkthrough, I will take you step-by-step through how to close the year-end books in Business Central. The same process I use to guide our clients at 425 Consulting Group. You will also find pro tips to make the process smoother and answers to the most frequent questions we get each year.

The first step in any year-end close is to confirm that the team has posted every entry for 2025. This includes recurring journals, accruals, depreciation, and any adjusting entries that belong to this fiscal year.

If you notice anything missing, take care of it now because once the year is closed, making changes becomes much more complicated.

💡 425 Pro Tip

Before you close the year, compare your Trial Balance totals to your Balance Sheet and Income Statement totals to make sure no accounts or entries were left out of your financial report structure.

Once your entries are complete, you are ready to close the year administratively inside Business Central.

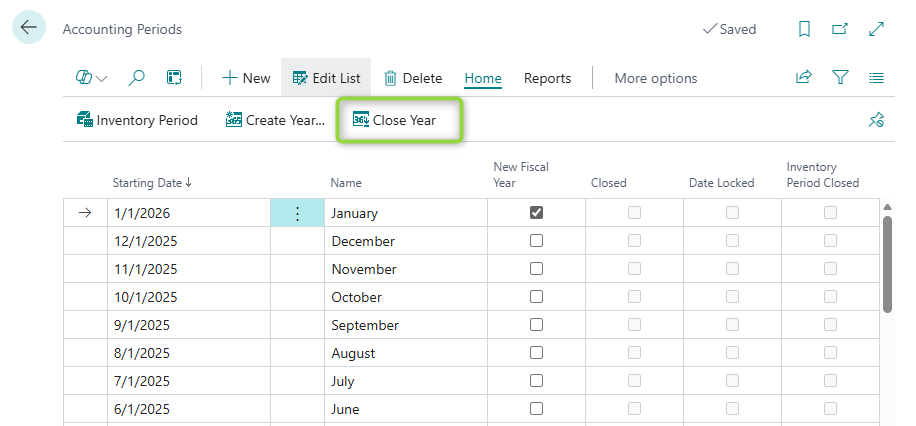

Search for “Accounting Periods.” You will see all your fiscal years listed. Select Close Year, and Business Central will prompt you to confirm.

Once you close those dates, you lock them, and you cannot reopen them directly.

💡 425 Pro Tip

If you manage multiple companies, close each company in order. Start with the entities that roll up into others, so your consolidated numbers stay consistent.

Before closing your income statement to retained earnings, take time to review and reconcile your balance sheet accounts. Make sure your subledgers, including Accounts Receivable, Accounts Payable, Inventory, Bank, and Fixed Assets match your General Ledger. You may find that you will have adjustments that could impact the income statement accounts.

Accounts Receivable, Accounts Payable, Inventory, Bank, and Fixed Assets match your General Ledger. You may find that you will have adjustments that could impact the income statement accounts.

This is your final check to ensure everything is accurate before you start the new year.

💡 425 Pro Tip

Run reconciliations before posting your closing entries. Fixing discrepancies early saves time and avoids reversal cycles later.

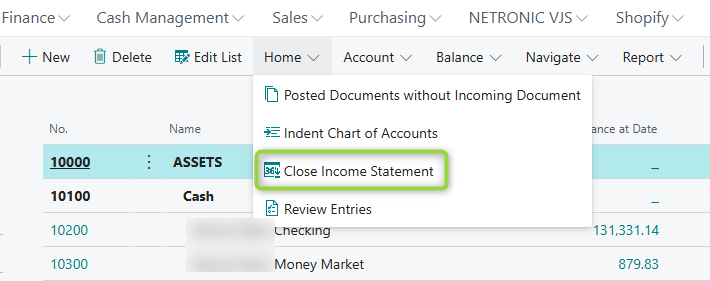

Closing the accounting period locks your dates. You still need to close the income statement to move your net income or loss into retained earnings.

Here is how:

Business Central will create a journal that zeroes out your income and expense accounts and posts the total to retained earnings.

💡 425 Pro Tip

Create a dedicated Year-End Closing journal batch. Keeping your closing entries separate makes them easy to find later if you ever need to review or audit them.

After running the Close Income Statement process, go to your General Journals and open the batch you selected. Review the entries that Business Central created. Be sure to check that your retained earnings account is correct, your debits and credits balance, and your totals make sense.

Once everything looks right, post the journal to complete the process.

💡 425 Pro Tip

Export the closing journal to Excel or PDF before posting. It is a small step that gives you a clean record for auditors or future reviews.

If you later discover that you missed something or need to correct it, you can fix it easily.

Here is how to make changes:

You do not need to redo the Close Year step. This only happens once.

💡 425 Pro Tip

Use consistent naming conventions like CLOSE2025 and CLOSE2025-REV. It makes future searches and audits much easier.

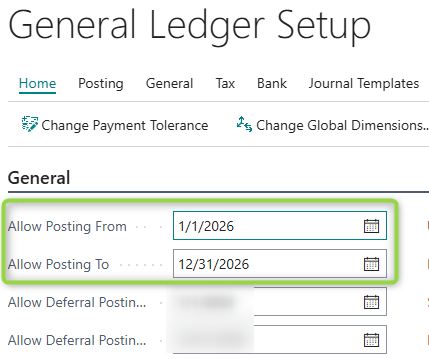

Once the closing entries are posted, protect your data by updating your posting dates.

Go to General Ledger Setup and adjust the Allow Posting From and Allow Posting To fields. For example, if you closed 2025, set your new posting range to begin on January 1, 2026.

💡 425 Pro Tip

During year-end, temporarily remove back-posting permissions for all users. It is the simplest way to prevent accidental postings to 2025.

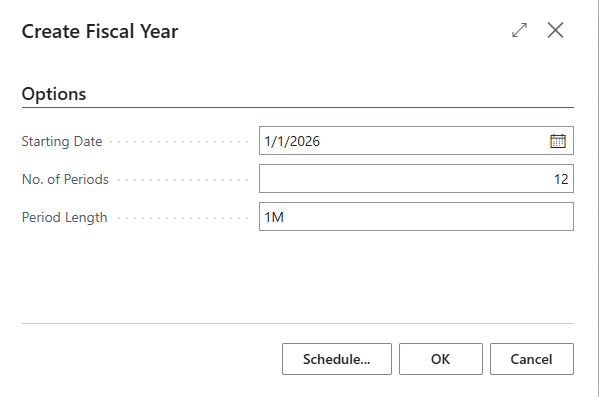

Finally, set up your new fiscal year.

In Accounting Periods, choose Create Year and define your 2026 periods. You can begin posting to 2026 right away — no waiting period required.

💡 425 Pro Tip

After setting up 2026, run your January trial balance immediately. It is a quick way to confirm your retained earnings rolled forward correctly.

Even when you follow the steps carefully, there are a few things that can trip you up. Watch for these common issues:

💡 425 Pro Tip

Keep a short checklist in Teams or OneNote with your year-end steps. It will save you time and reduce errors when you reuse it each year.

Here is what we recommend to every 425 client:

💡 425 Pro Tip

Schedule a quick “post-close review” meeting in January 2026. Capture what worked well and what could be smoother next year. The future you will thank you.

Some businesses try to get around Business Central's limits. They do this by splitting large payments into smaller batches. Others print checks outside the system. These approaches create new problems:

Here are some of the most common questions we get from clients about year-end closing in Business Central.

Update the "Income/Balance” field for the account and rerun the close. Business Central will adjust your retained earnings automatically.

Yes. When you run Close Income Statement, you can choose to close by dimension. This provides detailed retained earnings by department or project.

Absolutely. Running a test close in a sandbox helps catch setup issues and ensures your retained earnings account is correct before you close live data.

Business Central will mark those as prior-year entries. Just rerun the Close Income Statement to include them in retained earnings.

Closing your books for 2025 in Business Central does not have to be stressful. With a clear plan and the right process, you can finish the year strong and step into 2026 with confidence. For an additional resource, view my video on Steps for Closing the Year-End in Business Central on our YouTube channel.

At 425 Consulting Group, our team of ERP consultants for Business Central live and breathe it. We help you use your ERP system effectively. This way, you can work better, make confident choices, and grow your business with reliable data.

If you’re looking for a partner who understands both the technology and the business side of ERP, let's start a conversation. We are here to guide you.

Spencer Kriz is a Functional Consultant at 425 Consulting Group where he leverages his Microsoft certification and course management expertise to design, implement, and support Microsoft Dynamics 365 Business Central solutions. Additionally, he is responsible for developing training videos that support our client’s ongoing success.

Visit our Business Applications page to learn how an ERP Solution can transform your organization and propel future growth. Our consulting team is available to discuss your specific needs. Let’s start a conversation.